Chapter 10: Bingo—In Pooling Bingo Halls

10.1.0. Introduction

This chapter contains the policies and procedures for licensing charitable gaming events, including bingo and break open ticket events, in pooling bingo halls. The Registrar’s licensing framework for charitable gaming events in pooling bingo halls is also known as the Bingo Revenue Model (BRM).

The BRM is governed by:

- the Lottery Licence Terms and Conditions

- the Charitable Gaming Events Conducted and Managed in Pooling Bingo Halls Terms and Conditions

- Financial Management and Administration of Pooling Bingo Halls Terms and Conditions

- the Standards and Directives issued by the Registrar

- any additional terms and conditions that may be imposed by a licensing authority.

The Lottery Licence Terms and Conditions (a) are the core terms and conditions common to all lotteries with the focus on honesty, integrity and accountability.

The Charitable Gaming Events Conducted and Managed in Pooling Bingo Halls Terms and Conditions (b) are the terms and conditions specific to pooling bingo halls with the focus on the conduct and management and rules of play.

The Financial Management and Administration of Pooling Bingo Halls Terms and Conditions (4242) are the terms and conditions specific to pooling bingo halls with the focus on financial management and administration.

Standards and Directives (d) are issued by the Registrar as required.

10.1.1. AUTHORITY TO LICENSE

Both the municipal licensing authority and the Registrar are involved in issuing either charitable gaming event licences or authorizations, consistent with the Order-In-Council. (See also “1.2.1(C) Order-in- Council 208/2024”)

10.1.1 (A) Municipal licensing authority

- Municipal licensing authority assesses eligibility, use of proceeds and issues authorizations.

- Municipal licensing authority has the ability to inspect premises, attach additional terms and conditions (provided they do not conflict with the Registrar’s terms and conditions) as well as suspend and revoke authorizations they issue.

- Municipal licensing authority may collect a fee for issuing an authorization up to a maximum, prescribed by the Registrar, per event.

10.1.1 (B) Provincial licensing authority

- The Registrar reviews game structure and issues a licence to member organizations of the Hall Charities Association in conjunction with the municipal licences.

- The licensing fee is collected as a percentage of wagering prescribed by the Registrar.

10.2.1. Non-Pooling Bingo Halls

Bingo halls that do not pool operate under another revenue model (60/40 split with caps), terms and conditions and policies and procedures as set out in Chapter 9, “Bingo—In Non-Pooling Halls.”

Hall Charities Associations have the option to adopt pooling and operate under the BRM.

10.2.2. WHAT IS THE BINGO REVENUE MODEL (BRM)?

The BRM applies to all pooling bingo halls. While the role of provincial and municipal licensing authorities remains in place, this model provides for flexibility in how charitable games are licensed, managed and conducted. Highlights of the BRM include:

- flexibility to design game schedules to match the current bingo market;

- a maximum percentage of wagering that may be given away as prizes is prescribed by the Registrar;

- a marketing fund established at eight to twelve per cent of bingo Win with responsibility for its use shared between charities and hall operators;

- all bingo hall revenues are split between charities and Operators of bingo halls;

- charities receive 45 per cent and Operators receive 55 per cent;

- charities pay for costs of administration, licence fees and authorization fees;

- Operators are responsible for all other expenses;

- a single-licence approach for all charitable gaming events conducted in pooling halls;

- no distinction between municipal and provincial games.

10.2.2 (A) Overview: Bingo game flexibility framework for pooling halls

A key component of the framework is that it allows for flexibility in designing games and game schedules as the charities, with the advice of the hall, best see fit to meet their market needs. However, recognizing that accountability and public confidence in the games must be maintained, the following set of guidelines may be used to assist in game development and as a review tool for the licensing official for determining appropriate game schedules. If a licensing official receives an application for a bingo game that he or she is not familiar with, the official must first ensure that the bingo game in question is one for which a licence is available.

10.2.3. GUIDELINES FOR PERMITTED GAMES

10.2.3 (A) Base for bingo and game flexibility

- Games must be conducted using a fixed combination of numbers and/or symbols to a maximum of 90. Examples: B,I,N,G,O, and numbers one (1) to seventy-five (75), or numbers one (1) to ninety (90), or numbers one (1) to eighty (80).

- Customers may choose the numbers or symbols to appear on their bingo paper provided that specific controls have been implemented to track all numbers in play.

- Programs may include any number of games or combination of games.

10.2.3 (B) Prizes

- Prizes may be fixed, variable, progressive or a combination. (Example: variable prizes could include using the value of the final number called when a bingo game is won as the multiplier to determine the total value of the prize awarded.)

- Games may include non-fixed prize payouts and have no guaranteed prizes provided that specific controls have been implemented.

- There are no restrictions on minimum or maximum payouts per game/event (that is, minimum prizing may be set out in the house rules).

- There are no restrictions on the base amount for the purpose of developing the prize for any game, including progressive-type games (that is, seeding of prize pots).

- Prizes may increase by percentages or a set amount.

10.2.3 (C) Win based on pattern

- Winning combinations to achieve bingo may be based on a pattern or combinations such as fixed or rotating symbols or full card.

- Games may include wild numbers provided that specific controls have been implemented to track all numbers in play.

10.2.3 (D) Pre-calls

Pre-called games are bingo games where a large number of calls are required to determine a winner, so some numbers are called at the beginning of the event to allow the game to be played more quickly. Pre- called games are usually games that will offer larger prizes and are often referred to as ``Special`` games. Sealed bingo cards must be used for pre-called games.

- There is no restriction on the number of pre-calls allowed provided only sealed bingo cards are used and no ancillary prize (line prize) is awarded.

- Buy-back cards may be offered at a reduced price provided sealed cards are used and proper controls have been implemented to identify and track the card.

10.2.3 (E) U Pick game

The U Pick game (also known as “pick a bingo” or “do-it-yourself bingo”) allows players to choose the numbers on their game cards. The following procedures must be followed for this game to be approved on the schedule:

- Paper may only be sold in sequential order and only from a stationary location; floor sales are not permitted.

- The name of the bingo hall must appear on the paper.

- A breakdown of eligible tickets in play for each specific game must be provided to the caller prior to the start of each U Pick game (for example, 001 to 120).

- The licensee’s portion of the bingo card must be separated and bundled for each game and retained for a period of at least 30 days from the event.

10.2.3 (F) Level of winning based on factor beyond pattern

- Games may be based on achieving a winning combination within any number of ball calls.

- In the case of a progressive game the number of ball calls may increase until the prize is won provided the manner in which it increases is applied consistently throughout the duration of the progressive game.

- Increasing the number of ball calls may be based on different factors such as time period elapsed, wagering level achieved or prizing level reached.

- Games may be based on obtaining a winning combination containing a certain number which may be determined as the number following an indicator number or some other means (also allows new factors such as colours to establish distinctions for tiered prizing).

10.2.3 (G) Exit strategy/determination of winner

- An exit strategy or manner in which the game is guaranteed to conclude must be identified.

- The conclusion may be based on a specified time period, a prize level being reached or the game may be designed in such a fashion as to guarantee a conclusion. (Example: a game based on the number of ball calls that increase would be guaranteed to conclude at some point however a game based on an indicator number would require a conclusion point to be identified as either a prize maximum or a pre-established must-go date.)

10.2.3 (H) Additional guidelines

- Numbers in play must be determined using bingo balls or bingo playing cards in accordance with the terms and conditions.

- All games must be played on paper, laminated paper, hard card, plastic cards or through a table board device.

- Bingo must not be played solely on a Personal Bingo Verifier (PBV). (See “10.10.1(e) Personal bingo verifiers (PBVs)”, for more information.)

- All prizes must be awarded in cash, merchandise or a combination of the two.

- There are no minimum time periods required between sessions.

- There is no minimum or maximum number of games that may be played per session.

- Multiple sessions may be played in separate areas within the same bingo hall.

- Overall bingo prize board across all games conducted and averaged over each quarter must not exceed the maximum average of wagering prescribed by the Registrar.

- Monthly interim reports must be submitted in order to identify any potential issues with reaching the maximum prize board percentage prescribed by the Registrar.

10.2.4. BINGO GAME SCHEDULE REQUIREMENTS/GUIDELINES

The following details must be provided at the time application is submitted:

- the type of game being played;

- how each game will be conducted;

- the pricing;

- the prizing and how it is calculated;

- how winners are determined; and

- how the game will be guaranteed to come to a conclusion.

The above information must be made readily available to all customers and may be made available through a combination of:

- the game schedule

- rules of play, and

- house rules.

10.3.1. Overview: Licensing Process Framework

Step 1.0: HCA Administrator receives and reviews individual charity applications

Each member organization of the Hall Charities Association (HCA) must complete the Charitable Gaming Application form (4220) and submit it to the HCA Administrator along with its municipal authorization fee and a signed member declaration form.

Step 2.0: All applications and supporting documentation are compiled for each pooling bingo hall

All applications are compiled along with supporting documentation to form a complete package for each pooling bingo hall.

The HCA Administrator assembles all the CGAFs, municipal authorization fees and member declaration forms to be sent to the municipal licensing authority.

The HCA Administrator must complete and provide the following supporting documentation to the municipal licensing authority:

- a Charitable Gaming Summary form

- a Charitable Gaming Spreadsheet

- signed Member Declaration forms

- Game Schedules

- Game Rules

- House Rules.

Step 3.0: Package received

Upon receipt of all of the documentation noted in step 2.0 above, the municipal licensing authority is responsible for:

- Fully reviewing the CGAFs, including conducting eligibility reviews as required in order to issue the individ- ual charity authorizations. All charitable gaming authorizations that the municipal licensing authority issues must be sent to the HCA Administrator to be posted at the bingo hall.

- Reviewing the supporting documentation (Gaming Summary Package) and recording all municipal authori- zation numbers that it has issued onto the Charitable Gaming Spreadsheet.

- Returning the following package of information to the Bingo Hall Charity Association for submission to the AGCO.

- a Bingo Hall charity Association form

- a Charitable Gaming Spreadsheet

- signed Member Declaration forms

- Game Schedules

- Game Rules

- House Rules.

Step 4.0: HCA administrator submit gaming summary package to AGCO

HCA Administrator required to complete Bingo Hall Charity Association Licence application to the Registrar.

Step 5.0: Bingo lottery events conducted

10.3.2. OVERVIEW: ROLES AND RESPONSIBILITIES OF MUNICIPAL LICENSING AUTHORITY AND REGISTRAR

Applications

|

MUNICIPAL LICENSING AUTHORITY |

REGISTRAR |

|

|

|

|

hall and forwards authorizations to the HCA Administrator |

|

|

|

|

MUNICIPAL LICENSING AUTHORITY |

REGISTRAR |

|

|

Both licensing authorities receive monthly reports, which are due 30 days following the end of each month, from the HCA Administrator detailing:

| ||

» net lottery proceeds received; » all expenses paid; » use of proceeds; and » balance remaining. |

regular intervals as required (see also “10.7.2. Maximum prize board”) |

|

| ||

Licensing periods

The licensing process for lottery events conducted in pooling bingo halls requires the issuance of an authorization from the municipality and a licence from the Registrar.

The licensing officials must ensure that the authorization and the licence are issued for the same time periods. Since the municipal authorization is issued first, the Registrar’s licence will reflect the authorization period that has been determined by the municipal licensing official.

The licensing period must not exceed one year.

10.4.1. Roles And Responsibilities Of The Hall Charities Association Administrator

To assist in fulfilling its responsibilities, the HCA must retain the services of a Hall Charities Association Administrator (HCA Administrator) who is registered under the Gaming Control Act, 1992 and meets the applicable Standards for Suppliers of Goods and Services: Bingo.

The HCA Administrator’s responsibilities are set out in the Charitable Gaming Events Conducted and Managed in Pooling Bingo Halls Terms and Conditions. The HCA Administrator coordinates and administers the activities of the HCA including:

- Coordinating the submission of all authorization applications for the individual charities. (Charities are responsible for completing and signing their own individual authorization applications)

- Filing the authorization applications with the licensing authorities.

- Coordinating consistent preparation of charitable gaming event reports. Event reports must be completed by the individual charity following its event.

- Providing licensing authorities with an electronic report detailing the monthly gross wager and prizes paid for bingo (to calculate the percentage prize board), total revenues, administration costs and licence fees, and the disbursement of funds to the HCA member charities.

- Making monthly statements available to each member organization of the HCA upon request or as required.

- Administering one trust account for the marketing fund.

- Administering and maintaining one lottery account to track all revenue.

- Administering and maintaining one lottery trust account to deal with U.S. funds, if applicable.

- Scrutinizing reports and calculations of other revenues from the Operator and calculating Operator portion of the lottery proceeds.

- Processing payment of licence and authorization fees from the lottery trust account.

- Processing payment of HCA administration costs from the lottery trust account.

- Calculating and processing distribution of net proceeds to individual member charities.

- Assisting HCA in preparing recommended session schedule or dates and times for each member organization for approval by the municipal licensing authority.

- Reviewing Operator recommendations for game schedule including game mix and prizing to ensure compliance with the prize board requirements, recognizing the expertise of the Operator

- Complying with and ensuring compliance with all applicable Standards and Directives prescribed by the Registrar;

- Preparing financial and other reports requested by the licensing authority.

10.4.1 (A) HCA Administrator policies

- The HCA Administrator is an employee of the HCA and may be paid for his/her services from charity revenues as a reasonable and necessary administrative expense.

- An HCA Administrator may work at more than one bingo hall.

- An HCA Administrator must maintain an arm’s length relationship with the Operator of the bingo hall.

10.4.1 (B) Registration of HCA Administrator

The HCA Administrator must be registered as a Gaming-Related Supplier under the Gaming Control Act, 1992, must be able to fulfil all of the responsibilities set out in Section 10.4.1 (above).

10.4.1 (C) HCA Administrator: conflict of interest

An HCA Administrator must not act as a bona fide member in the conduct and management of charitable gaming events at the hall where he/she is the HCA Administrator; however, he/she may serve as a member-at-large of a member organization.

See also “3.5.3. General conflict of interest guidelines”, and “9.2.2. Conflict of interest guidelines” for further information.

10.5.1. Staffing Charitable Gaming Events

In addition to bona fide members, charitable gaming events must be staffed by runners who are provided by the bingo hall. Other responsibilities must be fulfilled by employees of the Operator of the bingo hall registered under the GCA to provide services such as calling the game or selling break open tickets (BOTs).

10.5.1 (A) Bona fide members

Bona fide members are needed to meet Criminal Code requirements for charities/licensees to conduct and manage a charitable gaming event. The role of bona fide members is a necessary part of conducting and managing lottery events in a pooling bingo hall.

A minimum of two (2) bona fide members are required to conduct and manage each lottery event for which a licence has been issued.

The role of a bona fide member at a charitable gaming event is detailed in the Terms and Conditions for Charitable Gaming Events Conducted and Managed in Pooling Bingo Halls. The Operator of the bingo hall may provide advice to assist in business decisions.

10.5.1 (B) Runners

A runner is a person on the floor whose responsibilities include selling paper, identifying winners and paying out prizes. Runners do not require registration under the Gaming Control Act, 1992 unless their responsibilities include selling break open tickets on the hall floor.

Runners working on the floor of the bingo hall are required to be employees of the Operator of the bingo hall and as a result are paid for by the Operator.

Even though the Operator must provide the runners for charitable gaming events, bona fide members of charities are responsible for the distribution and reconciliation of all bingo paper, break open tickets, and raffles.

10.5.1 (C) Volunteer runners in a charity-run bingo hall

In a charity-run bingo hall where four or more lottery events are run within a seven-day period, reimbursement of volunteer runners is not permitted.

A charity-run bingo hall is responsible for ensuring it is meeting all applicable laws as an employer.

10.5.1 (D) Volunteers

Volunteers may be members of the licensees in the Hall Charities Association or family, friends or volunteers from other member organizations who receive no reimbursement for out-of-pocket expenses.

10.5.1 (E) Full-time employees of licensee

Full-time employees of the charitable organization may volunteer to assist at charitable gaming events, provided that their primary duty is not providing gaming services.

10.6.1. Revenue Splits

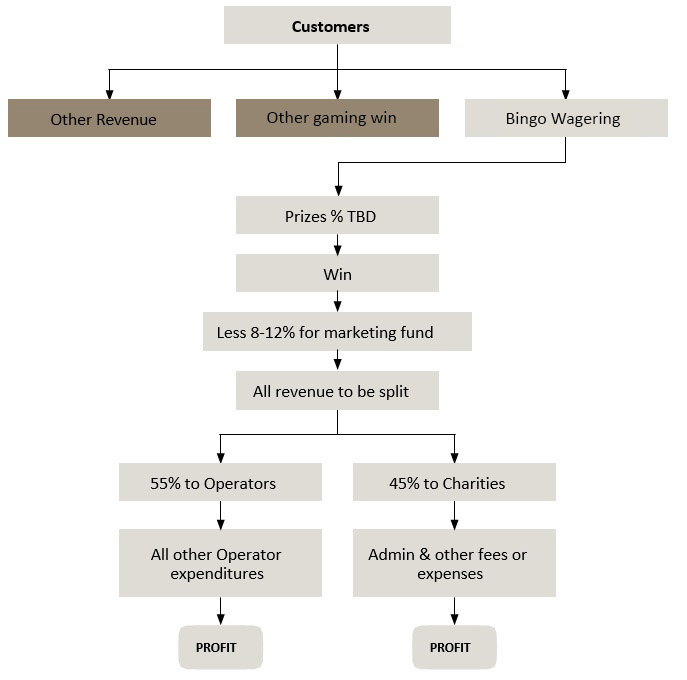

Under the Bingo Revenue Model, after payment of certain expenses, all revenue streams, from gaming and non-gaming sources are split between the charities and the Operator, with 55 per cent to the Operators and 45 per cent to the charities. As shown in Figure B below, revenue streams include:

- other revenue (for example,, food and beverage sales);

- other gaming Win (for example, break open ticket sales); and

- bingo wagering.

Key Points

- Revenues from BRM sales after prizes and the commission from the sale of Ontario Lottery Gaming (OLG) products are considered part of the revenue that is split between the Operator and the charities

- Games offered in the hall are considered part of the revenue that is split between the Operator and the charities

- There is no distinction between lottery and non-lottery revenues earned by the charities in terms of necessary and reasonable expenses and use of proceeds. The 45 per cent a licensee receives is considered lottery proceeds and must be used in accordance with the requirements on expenses and use of proceeds.

Figure B: Bingo Revenue Model – “Revenue Splits”

Where food and beverage sales at the bingo hall have been contracted out to a third party paying a monthly rental fee to the Operator, all of the gross sales from the canteen must be included in the 55/45 split between the Operator and charities.

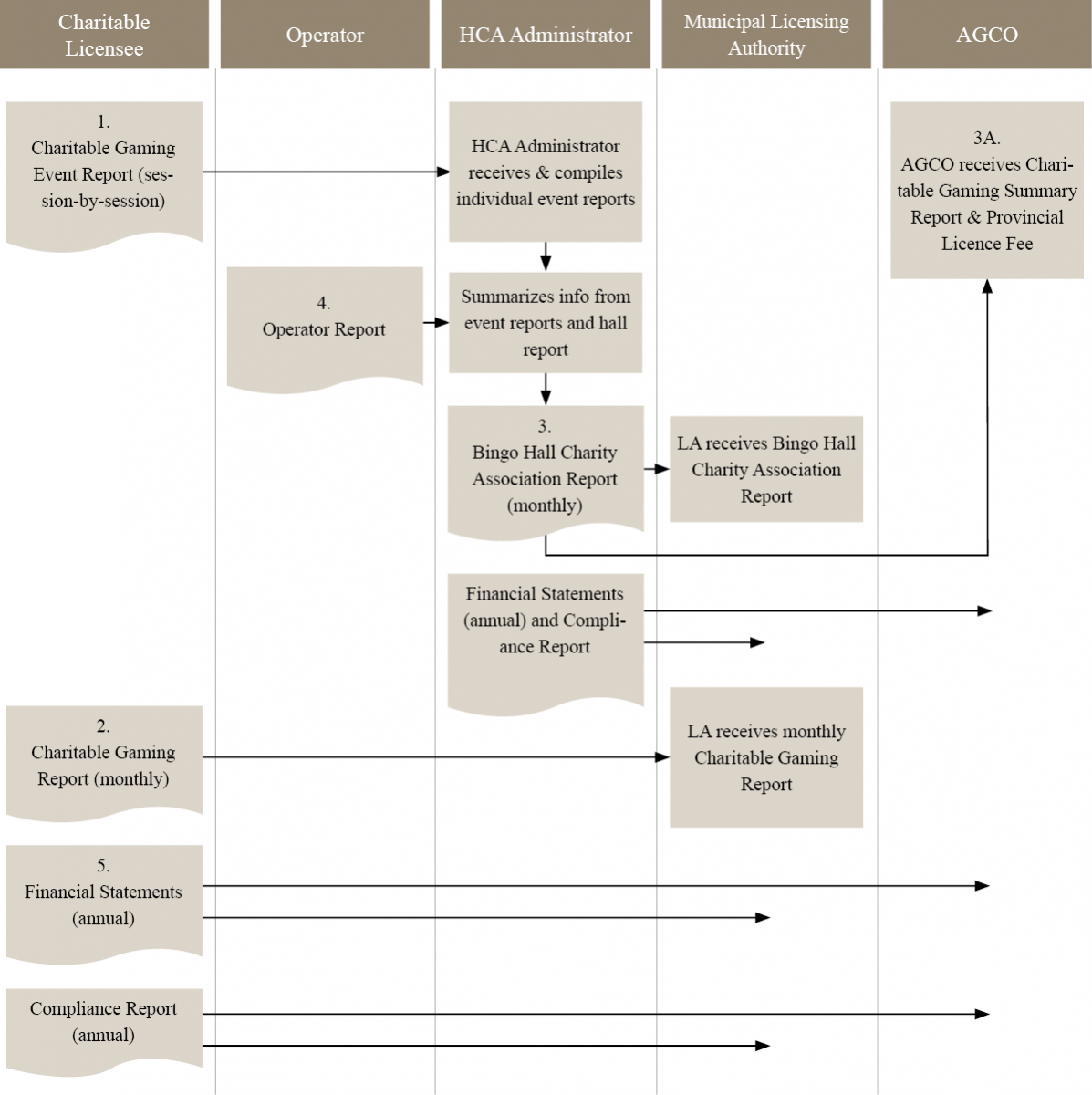

Figure C: Financial reporting process for charitable gaming events

- After payment of prizes and the five (5) per cent BOT fee directed to the HCAs (CDTA), BOT revenues (forming part of the “Other Gaming Win” revenue stream) are split, with 55 per cent flowing to the Operator and 45 per cent flowing to the charities.

- Licensees are responsible for paying licence and authorization fees and their administration costs. The Operator is responsible for all other expenses associated with supplying and selling BOTs in the hall.

10.7.1. Reporting Requirements

Refer to Figure C to guide you through the financial reporting process for charitable gaming events.

Step 1: Charitable Gaming Event Report

Charitable licensees (member organizations) are responsible for event-by-event record keeping at the conclusion of each event and must provide copies of Charitable Gaming Event Reports (Event Reports) to the HCA Administrator, who coordinates monthly reports on their behalf. At minimum, the report must include:

- gross receipts and prizes from bingo,

- gross receipts and prizes from break open tickets,

- gross receipts and prizes from raffles,

- authorization fees and,

- reimbursement of out-of-pocket expenses.

Step 2: Charitable Gaming Report

Charitable licensees must also complete a monthly Charitable Gaming Report showing:

- revenues,

- expenses,

- use of proceeds and

- balance.

This report must be filed with the municipal licensing authority in order to allow for ongoing reporting relating to the use of proceeds.

Step 3: Bingo Hall Charity Association Report

The HCA Administrator compiles the individual Event Reports on behalf of the member organization into a Bingo Hall Charity Association Report. The report must be submitted, to both licensing authorities, 30 days following month-end and include the following information:

- wagering for each type of lottery

- prizes for each type of lottery

- all gaming and non-gaming revenues

- authorization fees for the month

- out-of-pocket expenses for each event

- shortage (if any) for each event

- total deposits for the period

- administrative expenses paid in the month

- HST and any other applicable taxes paid in the month

- other revenue from Operator

- amount of overall revenue paid to Operator

- list of members of HCA and their share of net proceeds for the month

- marketing fund information.

- where American currency is accepted, the date of the transfer of accumulated American funds from the American currency account to the Canadian currency account, the exchange rate and the premium or loss on the transaction (see “3.6.5. Lottery Trust Accounts for American Currency”).

This report, along with the Operator Report (see item 4), must be filed with the municipal licensing authority and the Registrar.

- The municipality uses this information to monitor wagering activities and charity disbursements.

- The Registrar uses this information to ensure that the prize board has not exceeded the maximum prize board percentage prescribed by the Registrar (see “10.7.2. Maximum prize board” for further information).

Step 3.A: Provincial licence fee

The provincial licence fee is prescribed by the Registrar and is calculated as a percentage of gross wager on bingo, break open tickets and raffles. The fee must be submitted along with the Bingo Hall Charity Report on a monthly basis.

Step 4: Operator Report

The Operator Report must be completed by the Operator of the bingo hall and submitted to the HCA Administrator on a monthly basis.

The HCA Administrator uses this information to verify gross revenues from the sale of non–gaming related products (for example, concessions, dabbers, and so on). The Administrator may also obtain additional information from the Operator.

If the HCA is not satisfied with the Operator’s Report on the gross revenue from the sale of non–gaming related products, the HCA may withhold the disbursement of funds from the revenue generated as a result of lottery events.

The HCA must report any conflicts or disagreements to the Registrar.

Step 5: Financial statements

The Lottery Licence Terms and Conditions require licensees and HCAs to prepare financial statements covering revenues from all their sources (gaming and non-gaming). The type of financial review required depends upon the licensee’s gross annual revenues from all sources.

If gross revenues are under $250,000, the financial statements must be prepared and approved by the charity’s Board of Directors. If gross revenues are over $250,000 audited financial statements are required.

If gross revenues are under $250,000 but another statute (for example, the Corporations Act) requires audited statements, it must have its statements audited.

(See the Lottery Licence Terms and Conditions “Reporting Requirements”, Sections 3.8 and 3.10 (a) and (b) for more information.)

The financial statements must be made available upon the request of the licensing authority along with any other information the licensing authority deems necessary.

Audit Fees

The licensee is permitted to pay the portion of the audit fee that is related to charitable gaming from gaming revenues.

10.7.1 (A) Compliance Report required

The licensee must submit a summary of compliance with the terms and conditions, applicable terms prescribed by the Registrar, the Standards and Directives prescribed by the Registrar and any additional terms and conditions imposed by the licensing authority.

See Lottery Licence Terms and Conditions “Reporting Requirements”, Section 3.8(b).

10.7.2. MAXIMUM PRIZE BOARD

How licensees (with the assistance of Operators) manage their prize boards is a critical component to the success of bingo. In addition to the bingo flexibility framework, the Registrar has prescribed a maximum percentage average of wagering that may be given away as prizes.

While individual games or sessions may be higher than the prescribed percentage in prizes, the overall average over each prescribed three-month period must not exceed the maximum allowable prize board.

10.7.2 (A) Prize board reporting policies

To ensure that the prize board averages are being met across the province, each HCA must file a monthly report with the Registrar showing gross wagering and prizes paid.

The HCA must establish a separate ledger for money that is “committed to” or accruing for progressive- style games so that the prize payouts are secure. In other words, there must be sufficient funds in the lottery trust account to pay out the prize money whenever the progressive prize is won.

Only prizes that have actually been won and paid-out should be reported as part of the monthly report in order to calculate the percentage prize board.

The Registrar will conduct a review of prize board averages for each quarter to take into account fluctuations due to payouts for progressive style games and also to allow for seasonal fluctuations.

10.7.2 (B) Prize board monitoring policies

The Registrar will contact licensees and Operators that are not achieving the required prize board levels to ensure that they are moving appropriately to reduce the prize payouts.

Where the licensee and Operator fail to demonstrate compliance, the Registrar may take disciplinary action, issue directives or utilize regulatory enforcement measures.

The Registrar’s action will be decided on a case-by-case basis, by considering the specific circumstances of each situation.

10.8.1. Lottery Trust Accounts

The following rules apply to lottery trust accounts for individual licensees:

- A licensed organization must open and maintain a separate lottery trust account, designated as a trust account by the branch of a recognized financial institution, in the Province of Ontario.

The designated lottery trust account must be in Canadian funds. If the licensee (except for a Hall Charities Association in a pooling hall) conducts more than one type of lottery event, it may hold either one designated lottery trust account for all lottery proceeds or a separate designated lottery trust account for each type of lottery. - If the licensee maintains only one lottery trust account, the licensee must keep a separate ledger for each type of lottery event and for each licence issued.

- All cheques or withdrawal require the signatures of at least two (2) bona fide members of the licensee.

- Licensees may use electronic funds transfer (EFT) to pay for expenses, to deposit revenues and/ or to distribute net proceeds derived from the conduct of charitable gaming events for objects and purposes approved in the application for licence.

See also 3.7.0, “Electronic funds transfer (EFT)”. - A licensee cannot move funds by any means from the designated lottery trust account(s) into its operating or general account(s).

The following rules apply to lottery trust accounts for HCAs in pooling halls:

- The HCA may open either a separate consolidated designated trust account (CDTA) for each type of lottery event or one (1) CDTA with separate ledgers as permitted under the Financial Management and Administration of Pooling Bingo Halls Terms and Conditions.

- An HCA whose member organizations are permitted to accept American currency must also maintain a separate CDTA in American funds as per the Financial Management and Administration of Pooling Bingo Halls Terms and Conditions.

- A minimum of four (4) bona fide members representing four different member organizations must be designated to administer the CDTA.

- EFT may be used to disburse pooled lottery proceeds to member organizations’ lottery trust accounts in accordance with the Financial Management and Administration of Pooling Bingo Halls Terms and Conditions.

See also “3.6.10. Electronic funds transfer (EFT)”. - The HCA must open and maintain a separate trust account to administer the marketing fund in accordance with the Financial Management and Administration of Pooling Bingo Halls Terms and Conditions.

10.9.1. Bingo Shortages

At the conclusion of the bingo event if there are shortages as a result of errors made by runners on the gaming floor, the responsibility is assumed by the employer (Operator). Where the hall is owned and operated by the charity, shortages are made up based on who supplied the runners for the event. For example, if the event is staffed by volunteers of the licensee, the licensee would be responsible for covering the shortage.

Shortages incurred as a result of the Operator or its employees must be paid to the licensee conducting the charitable gaming event and be included as part of the net deposit for that event.

10.9.2. LOSSES

If the total of all three revenue streams—bingo revenues, other gaming win (for example, BOT sales) and other revenue (food and beverage sales)—results in a loss, the responsibility for the overall loss must be split between the hall and the members of the HCA. The members of the HCA are responsible for 45 per cent of the loss and the Operator of the bingo hall is responsible for 55 per cent.

10.10.1. Eligible Expenses

10.10.1 (A) Out-of-pocket expenses

The licensee may reimburse bona fide members for “out-of-pocket expenses” that are related to the charitable gaming event. These bona fide member expenses may include items such as meals,

transportation and babysitting expenses. Bona fide members may be reimbursed up to $20 per event, with receipts. Reimbursement of out-of-pocket expenses for volunteers is not permitted.

10.10.1 (B) Municipal fees

The licensing authority may charge fees not to exceed the amounts prescribed by the Registrar.

The fee, collected by the licensing authority, is submitted by the HCA Administrator on behalf of each licensee as part of its application package.

The HCA Administrator may pay the fee either by one cheque or individual cheques from HCA members.

10.10.1(C) Registrar’s licence fees

The Registrar’s fee has been prescribed as a percentage of the gross wager (actual monies wagered) on bingo and break open ticket events.

The Registrar collects licence fees on a monthly basis in arrears.

The fee is reported on and submitted with the Bingo Hall Charity Association Report.

10.10.1(D) Marketing fund

An amount of eight (8) to twelve per cent of all Bingo Win (gross bingo wagering minus prizes) must be set aside for a marketing fund within the hall (see “10.6.1. Revenue splits”, Figure B).

The purpose of the fund is to support the establishment of a marketing plan and the marketing activities it calls for. There must be joint decision making between the licensees and Operator to determine how best to spend this revenue.

The revenues for the marketing fund must be deposited into a designated marketing fund trust account.

Licensees must ensure that the HCA follows the terms and conditions prescribed by the Registrar for the administration of the marketing fund.

10.10.1 (E) Personal bingo verifiers (PBVs)

A personal bingo verifier (PBV) is a hand-held device that individual bingo players may use to track and verify numbers as they are called by the bingo caller during the bingo game. Under no circumstances does a PBV replace the conventional method of playing bingo with bingo paper and dabbers; rather, it is meant to assist players in keeping track of numbers that have been called.

No prize is paid to a player unless that person has dabbed, at minimum, the winning combination of numbers or symbols required to win on bingo paper prior to calling “bingo”.

- bingo must be played using bingo paper;

- while PBVs may be used by players to keep track of numbers called, players must dab their paper contemporaneously with the numbers being called (licensees should allow a moment for players to ensure that all numbers have been dabbed);

- prizes must not be paid unless the winning combination of numbers or symbols has been dabbed on the bingo paper;

- all bingos must be verified on paper and not through the use of a PBV; and

- lease, rent or purchase of equipment (PBVs) must be from suppliers that are registered under the Gaming Control Act, 1992.

See the Charitable Gaming Events Conducted and Managed in Pooling Bingo Halls Terms and Conditions.

PBVs are considered an operational expense and therefore paid for by the Operator of the bingo hall.

10.10.2. INELIGIBLE EXPENSES

The cost of printing programs and posting rules of play at bingo halls is not a marketing expense and must not be claimed within the maximum eight (8) to twelve per cent allowed for advertising and promotions. Programs and Rules of Play are not considered a form of advertising. It is an expense of the Operator.

Please also refer to the Pooling Bingo Halls: Advertising and Marketing Guidelines.

10.11.1. Application Of Harmonized Sales Tax (HST)

The following policies apply to the Harmonized Sales Tax (HST):

- Pooling of revenue

» The HST does not apply to the licensee’s share of the revenue split (45 per cent).

» The HST is payable on the bingo hall’s share (commonly referred to as “hall rent”) as defined in 6.8 of the Financial Management and Administration of Pooling Bingo Halls Terms and Conditions.

See also sample calculation on the following page.

- Bingo Hall — other revenue

» Bingo halls must collect HST on any taxable goods and service but can claim an input tax credit on any HST paid in providing those goods and/or services.

- Wagering

» HST is not collected from patrons purchasing paper or break open tickets.

- Prize payouts

» Payment of prizes is exempt from HST.

- Marketing fund

» HST is not payable as funds accumulate in the marketing fund. However, payments out of the fund (i.e., to suppliers) will be subject to HST unless otherwise specifically exempt from HST

- Reporting

» For all lottery events, the HST paid by the licensee for applicable services and supplies must be reported on the Bingo Hall Charity Association Report form.

For details on specific circumstances and any applicable taxes, please contact the appropriate financial authority.

Example: Calculation of HST on “Hall Rent”

Scenario:

- Net Bingo Revenue =$1,000.00

- Net BOT Revenue= $500.00

- HCA’s share of other non-gaming revenue= $45.00

| Steps | Example | ||

| Step 1. | Add net bingo revenue (bingo Win minus 8-12% for marketing fund) plus net BOT revenue = (A) | $1,000.00 | Net Bingo Revenue |

+$500.00 | Net BOT Revenue | ||

=$1,500.00 | (A) | ||

| Step 2. | Multiply (A) by 0.55 (Hall Operator’s share of gaming revenue) = (B) | $1,500.00 |

(b) Operator’s share of Gaming Revenue |

x 0.55 | |||

= $825.00 | |||

| Step 3. | Subtract the HCA’s 45% share of non-gaming revenue (concessions etc.), = (C) From the total in (B) | $825.00 | |

-$45.00 | (C) HCA’s share of Non-Gaming Revenue | ||

= $780.00 | (D) Hall Rent | ||

| Step 4. | This number is Hall Rent = (D). The HST is calculated on this number. (D) x .0513 = HST Payable on Hall Rent. | x 13% |

HST Payable on Hall Rent |

10.12.1. American Currency

Eligible organizations conducting bingo events in towns that border the United States may accept American currency during the conduct of bingo events, which may include break open ticket sales at bingo halls that have a substantial American clientele.

If the patron purchases bingo paper in American funds, any prizes won must be paid out in American funds. If the paper is purchased in Canadian funds, the prizes must be paid out in Canadian funds.

A Hall Charities Association whose member organizations accept American currency must maintain a separate American lottery trust account that has been designated as a trust account by the branch of a recognized financial institution in Ontario. American funds must be deposited into the American account.

All lottery expenses and funds for approved eligible uses must be paid from the Canadian account. The American account may only be used to deposit the American currency collected during the event, with the exception of withdrawals for a cash float for the conduct of a bingo event. Expenses, donations or any other withdrawals cannot be made from this account unless the licensing authority grants permission.

The maximum amount that may be accumulated in this account must not exceed the licensee’s estimated prize board.

When funds in the American account accumulate in excess of the estimated prize board, they must be transferred to the Canadian lottery trust account. The date of the transfer, the exchange rate and the premium or loss (at buying rate), as well as any donations made from the Canadian account, must be recorded on the financial report form (bingo hall charity association) and in the financial ledgers.