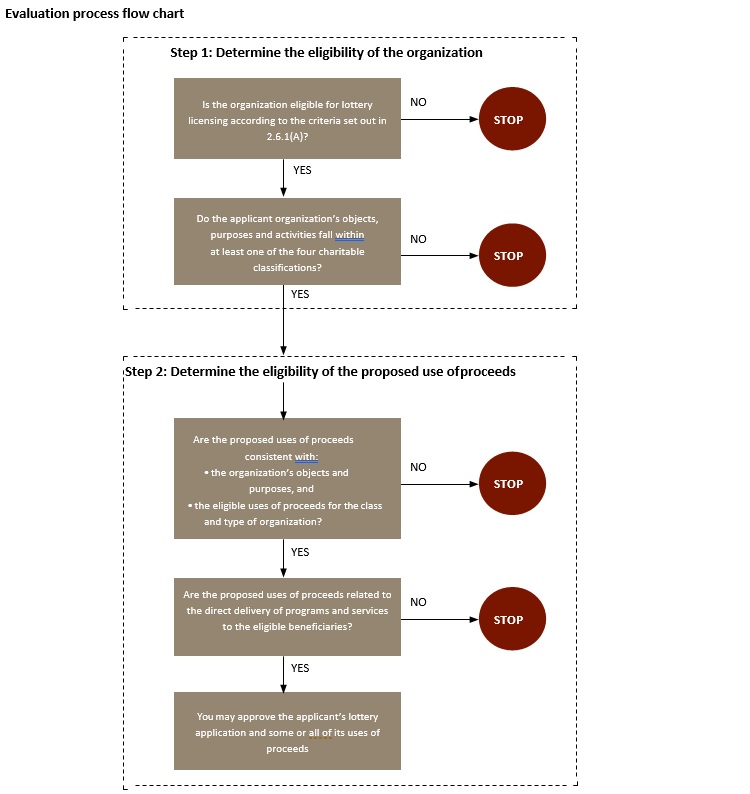

This section provides an overview of the process to determine whether or not an organization is eligible for lottery licensing, and whether or not its proposed use of proceeds is eligible.

STEP 1: Determine the eligibility of the organization

- Is the organization eligible for lottery licensing according to the criteria set out in 2.6.1(A)? If not, stop here. If the organization is eligible, continue.

- Do the applicant organization’s objects, purposes and activities fall within at least one of the four charitable classifications? If so, which one:

- the relief of poverty

- the advancement of education

- the advancement of religion

- other charitable purposes beneficial to the community, not falling under i), ii) or iii).

If the organization’s objects and purposes are eligible, continue to Step 2. If not, the organization is ineligible for a lottery licence and the process stops here.

STEP 2: Determine the eligibility of the proposed use of proceeds

To evaluate the use of proceeds, ask the following questions:

- Are the proposed uses of proceeds consistent with:

- the organization’s objects and purposes, and

- the eligible uses of proceeds for the class and type of organization?

- Are the proposed uses of proceeds related to the direct delivery of programs and services to the eligible beneficiaries?

If the answer to both questions is “Yes,” the applicant’s lottery application and some or all of its proposed uses of proceeds may be eligible for lottery licensing.

2.6.1. NEXT STEPS: EVALUATION GUIDELINES

2.6.1 (A) Evaluating the organization

To be eligible for lottery licensing, an applicant must have an established organizational structure. The applicant must be a legal entity and must have a formal document that establishes the organization. However, incorporation, whether provincial or federal, is neither a prerequisite nor a guarantee that a licence will be issued. No one may use lottery proceeds to start up an organization.

In order to be eligible, an organization must:

- have been in existence for at least one year;

- have provided charitable community services consistent with the primary objects and purposes of the organization for at least one year;

- have a place of business in Ontario;

- demonstrate that it is established to provide charitable services in Ontario;

- propose to use proceeds for charitable objects or purposes that benefit Ontario and its residents; and

- assume full responsibility for the conduct and management of its lottery events.

The terms and conditions for each lottery licence set specific application requirements, which are summarized in the relevant licensing policy sections of this manual.

When an organization first applies for any type of lottery licence, or whenever a review of its eligibility is required, it must provide all of the following information and documents that apply to it:

- a copy of its letters patent;

- a copy of its constitution and bylaws;

- a copy of its budget for the current year;

- a copy of its financial statements for the preceding year;

- a list of its Board of Directors;

- its latest report to the Public Guardian and Trustee;

- its charitable number for income tax purposes;

- a copy of its “Notification of Registration” letter from the Canada Revenue Agency with any supporting documentation, indicating the applicant’s status and terms of registration;

- copies of its charitable returns to the Canada Revenue Agency for the previous calendar year;

- a detailed description of its activities; and

- a copy of its annual report.

The organization must also provide any other information that will assist the licensing official to determine the charitable nature of its objects, purposes and activities.

After the review has been completed, the licensing officer may require additional information to process the application. The organization must provide any information that is requested.

If any changes are made to the documents submitted, the organization must provide the licensing authority with the amended documents as soon as they are available.

Because organizations change, an organization that is considered eligible for lottery licensing must continue to provide the licensing authority with any amended documents as soon as they are available.

Organizations that receive lottery licences will be subject to periodic eligibility reviews.

2.6.1 (B) Evaluating the use of proceeds

In order to determine eligible uses of proceeds, the organization must set out in detail its proposed uses of proceeds and to which programs the proceeds will be applied. The organization’s proposed use of proceeds must be for charitable programs and the programs must be consistent with the charitable objects and purposes of the organization. These objects and purposes must be of a charitable nature and fall within at least one of the four charitable classifications listed in Section 2.1.0.

In addition to the policies for “Use of Proceeds” and examples of “Eligible Uses of Proceeds” provided throughout this chapter, the following guidelines may be used to evaluate and determine eligible uses of proceeds:

- A copy of the most recent financial statements should show through past expenditures that contributions to support the charitable objectives of the organization have been made and that the organization is carrying out its charitable objects.

- The current operating budget should itemize each of the projected revenues and expenditures of the organization. The organization’s proposed use of proceeds (as detailed in the lottery licensing application) should coincide with the line items in their current operating budget. As well, the operating budget should demonstrate a need for the lottery proceeds.

- The use of lottery proceeds should be restricted to expenditures which are related directly to the delivery of the charitable programs provided by the organization. In other words, lottery proceeds must not be used for programs that are not part of the organization’s charitable objects and purposes identified in the constituting documents.

- In limited cases, certain administrative expenses related to the direct delivery of an eligible organization’s charitable objects may be considered eligible uses of proceeds. These costs must be essential to the direct delivery of the charitable services and must be approved by the licensing authority on a case-by-case basis. (See also “2.4.1(B) Direct expenses vs. indirect expenses” for further information.)

2.6.2. NEXT STEPS: ELIGIBILITY QUESTIONNAIRE

The licensing official must assess the applicant’s eligibility by asking the following questions. If the answer to any of these questions is “no,” the organization is ineligible.

- Does the organization’s purpose fall within one of the four classifications of charitable objects?

- If yes, which one:

- the relief of poverty;

- the advancement of education;

- the advancement of religion;

- other charitable purposes beneficial to the community, not falling under (a), (b) or (c);

- none of the above — stop here.

- Does the organization have a place of business in Ontario?

- Has the applicant been in operation for at least one year and does it have a proven charitable mandate that it has carried out throughout the year?

- Is the organization established to provide charitable services in Ontario and use proceeds for objects or purposes that benefit only Ontario residents? If not, has the organization requested a use of proceeds that is restricted to meet these requirements?

- Is the applicant properly organized so that it is separate organizationally, legally and financially from any other organization?

- Are the proposed uses of proceeds eligible?

- Is the intended use a direct delivery of services that is consistent with the charitable classification and the governing documents of the organization?

- Are the proposed charitable benefits open to all segments of the community? Or, if the charitable benefits are directed to a specified group of the public, are the benefits open to all segments of that group?

2.6.3. NEXT STEPS: CONSTITUTING DOCUMENTS

Every applicant organization must have a document that establishes the organization, setting out the members’ common purpose and detailing how the organization will operate in order to achieve that purpose. Formal documents include letters patent, constitution, and memorandum of association. Informal associations that have not adopted formal written constituting documents are not eligible for lottery licensing.

The organization must demonstrate that the following items are included in its constituting documents:

- the organization’s name;

- the organization’s object or purpose;

- a description of how an individual becomes a member of the organization and retains membership in the organization;

- a clause stating that the organization’s members will not derive any gain from the organization, and that any profits will be used solely to promote the organization’s objectives;

- a description of the organization’s structure (for example, president or chair, secretary, treasurer);

- a description of how the organization elects its directors;

- the signature of the officers who adopted the incorporating documents;

- the signature of at least three of the organization’s current directing officers, certifying that the incorporating documents are current and still in effect;

- the effective date of the instrument;

- a general dissolution clause that addresses the winding up of the organization; and

- a further clause (which may be contained in the bylaws) that, if the organization should dissolve, provides for the distribution of the organization’s assets and property held or acquired from the proceeds of licensed lottery events (that is, lottery trust accounts or property purchased with lottery proceeds) to charitable organizations that are eligible to receive lottery proceeds in Ontario.